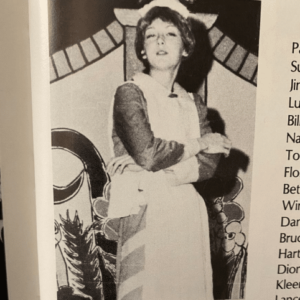

This picture is from high school, many moons ago, when I played the character of Pauline, the housekeeper, in the play No, No, Nanette! I would cook, tidy up, and keep the household organized and running smoothly. Far from being the star of the show (my sister was Nanette), I think back on that time and wonder if there was a little bit of typecasting going on. Pauline was a bit bossy but also had a good sense of humor. Hmm, as the oldest of four children (and now having had four children myself), I guess I could’ve been seen as a bit bossy. And I have always been grateful for my sense of humor!

This picture is from high school, many moons ago, when I played the character of Pauline, the housekeeper, in the play No, No, Nanette! I would cook, tidy up, and keep the household organized and running smoothly. Far from being the star of the show (my sister was Nanette), I think back on that time and wonder if there was a little bit of typecasting going on. Pauline was a bit bossy but also had a good sense of humor. Hmm, as the oldest of four children (and now having had four children myself), I guess I could’ve been seen as a bit bossy. And I have always been grateful for my sense of humor!

National Financial Literacy Month

I think this all ties into today as I reflect on this important month of April, National Financial Literacy Month. My passion for helping women get more comfortable with their finances may at times come across as being bossy. Forgive me. I have been on the other side with too many women over the past 20+ years who experienced divorce or widowhood. They were financially stressed, more from lack of comfort and awareness, at an already stressful (in so many other ways) time of their life.

Financial Housekeeper

I am on a mission to help women avoid that feeling during an inevitable time that almost all of us will face. And the best way to avoid it is to get organized now. Become your own “financial housekeeper.” By that I mean organize what you have so you better understand your big picture. And to do that, you need to start with a financial inventory that answers “What do I have?”

20th Anniversary

And what better time to get started on that goal than April? You may have seen, heard, or read other financial literacy efforts this month. 2024 is the 20th anniversary of the Senate resolution recognizing April as National Financial Literacy Month. The concept started with a Youth Financial Literacy Day established earlier by the National Endowment for Financial Education. The good news is that many more organizations are now on the bandwagon to help educate Americans of all ages about their financial life.

The Financial Awareness Foundation

The goal of this annual effort in April is to be a crucial reminder for all of us that this country needs to prioritize financial education as one way to develop, encourage, and support sound financial habits. Years ago, I learned about and jumped into supporting The Financial Awareness Foundation as an ambassador and board member. Their helpful free, downloadable personal finance tools and educational resources have spread across the globe.

My only disappointment is that the US seems to be the least interested country in getting large corporate sponsors and financial services organizations to proactively commit to the movement.

Get Your Docs in a Row

So in my own little world, I do what I can. I am offering a complimentary virtual workshop called “Get Your Docs in a Row” during the months of April and October that includes a FREE download of my favorite tool (and I believe most helpful), My Net Worth Summary. I invite you to consider jumping on Zoom for one of my workshops to get a head start on your financial inventory.

Am I Missing Anything?

Most of us don’t have a “housekeeper” that helps us keep things running smoothly. But you can take the role of being your own “financial housekeeper” by just taking a few steps. Since 90% of all women will eventually be solely in charge of their household finances, you should plan to have it all in your lap, if you don’t already.

Start with a financial inventory, then organize your records so it is decluttered and findable, and then take a closer look at your inventory to determine if anything needs to be “fixed” or updated to be “new improved.” My workshop gives you that double-check in case you’re wondering, “Am I missing anything?”

Passing the Baton

Lastly, remember that someday you will pass the baton on to someone else (that you have hopefully identified in your estate planning documents) to carry the torch of being your “financial housekeeper.” Make that job easier for them by taking action now to get your financial house in order and communicating with them about their role.

Let’s Have a Conversation:

Is your financial spring cleaning done or still waiting for you? What have you been busy with as your own “financial housekeeper”? What advice can you share with our community? Let’s have a discussion!

Marie Burns is a Certified Financial Planner, Speaker, and Author of the bestselling Financial Checklist books. Find Marie on Facebook or contact her at Marie@MindMoneyMotion.com

This article was first published at 60 and Me – a community that helps women over 60 live happy, healthy and financially secure lives.