Single Adults: Living on Your Own

Money Checklist Bundle for Single Adults

Are you living on your own, maybe for the first time or maybe it’s been awhile? Here are some money tools for your financial journey to help you stay focused on taking action on your goals.

Get the freebie

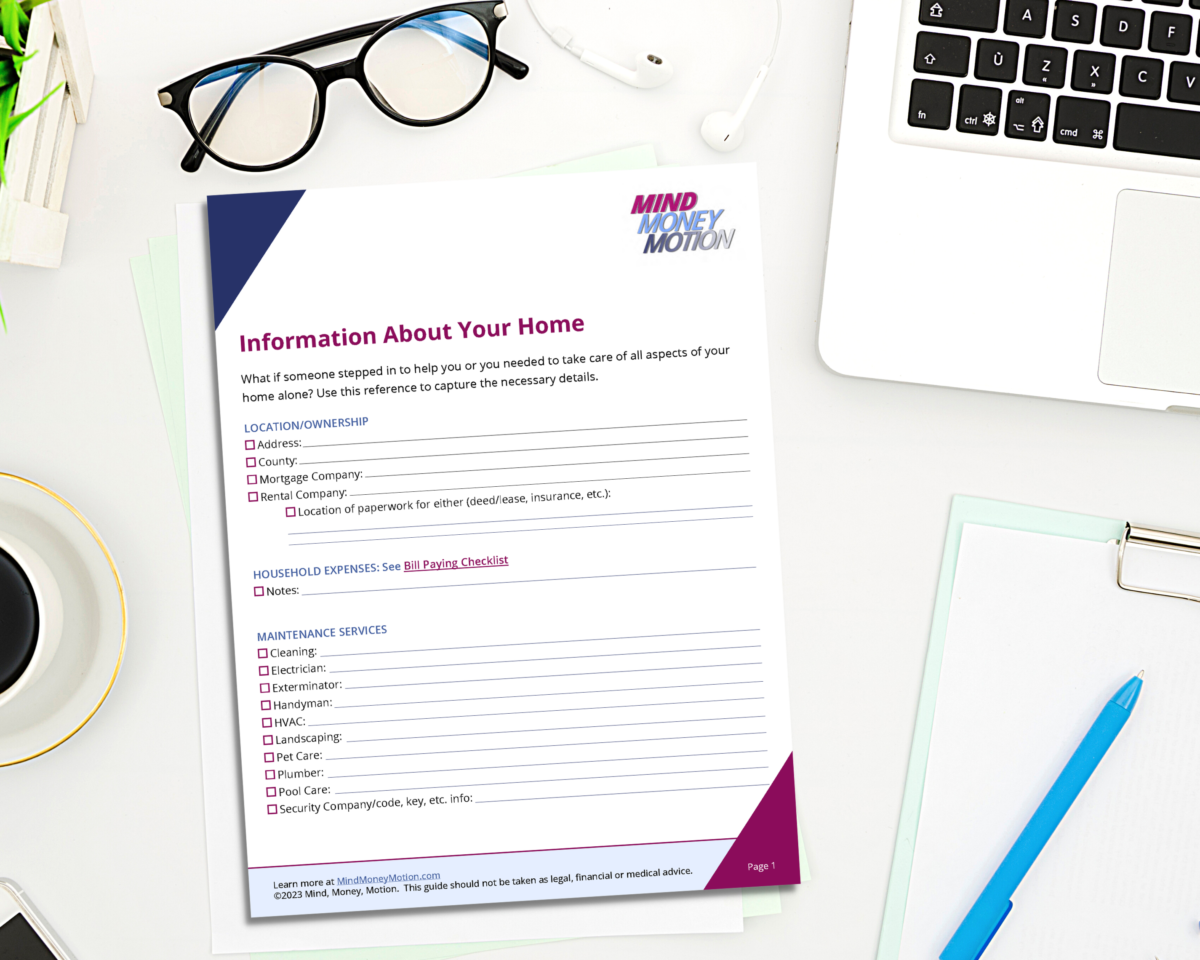

Information About Your Home Checklist

Gather your important home information and records with this free checklist.

By downloading, you are agreeing to receive communications from Mind, Money, Motion. You can opt-out at any time!

Get the bundle

Living on your own Bundle

Checklists and resources to help singles take charge of their money life.

Get started planning now!

Original price was: $15.00.$7.50Current price is: $7.50.

Living on Your Own Bundle

What You Get!

The Living on Your Own Bundle includes checklists PLUS financial tools and principles to learn about and apply smart money decisions in your life.

- Before and After Post-Secondary School Checklist

- Autopilot Your Finances Checklist

- Bill Paying Checklist

- Digital and Online Accounts Sheet

- Financial Checkup Quiz

- Financial Planning Calendar

- Historical Net Worth Sheet

- Information About Your Home Checklist

- Insurance Summary

- My Net Worth Overview

- Ultimate Home Money Makeover Checklist

Start building better money habits and get financially organized with the Living on Your Own Bundle.

Get the Living on Your Own Bundle today!

Original price was: $15.00.$7.50Current price is: $7.50.

Get Started Now!

What stage of life can I help you with?

- I’m recently widowed/divorced »

- I’m just starting out on my money journey (Ages 16-22) »

- My son/daughter is getting married soon »

- I want my family to be prepared for all life events »

- I just had a baby »

- I am ready to take steps to be financially organized »

- My children moved out of the house »

- I am retiring soon »

- I want to make sure my family has all my important information when I am gone »

- I don’t know where to start »

What others using these checklists have said:

More prepared for my future…

“This checklist will help me learn and be more prepared for my future when it comes to my finances as well as preparing for my future career.”