… creating better personal finance habits!

What good habits do we have, or wish we had? In business or our personal lives, a majority of our daily actions are actually completed out of habit without giving them much thought: our morning routine, our drive to work, our bedtime ritual. Have you ever caught yourself driving and asking yourself, did I stop at that stop sign back there? Did I close my garage door as I pulled out of my driveway? Did I lock my car door after I parked my car? Because those actions have become so familiar, they also become good habits that you do without thinking about them.

Our brains are wired for survival, therefore our brains ignore the familiar (but still take action on it) in order to focus instead on what’s new and different. That fact is referred to as “nose blindness.” I recently conducted a Behavior Change Bootcamp and helped my audience better understand nose blindness with the following example. Think of the last time you entered a room and smelled baking cookies, or homemade bread, or some other favorite aroma. Minutes later, your nose didn’t detect that aroma anymore. Yet if you left the room and came back again, you would smell it again. That is an example of how nose blindness works, your brain ignores the familiar so it can focus on the new and different instead. It is that exact understanding of how our brain works that we can leverage in both our personal and professional lives to our advantage.

Take personal finance, for example, since it applies to all of us. If we can do things so routinely that we don’t think about them, voila! we have a new habit! Whether we own a business, are employed by a business, or are retired, we still have a personal life where good personal finance habits in our home office are a must (personal records organized and automated saving/investing in place). Being financially organized helps us know what we have and that is the foundation for all of our financial decisions; it also allows family to make sense of it when needed. Afterall, it is not if but when we will no longer be around to do all the things we are taking care of today.

So how do we leverage our brain to help us create good personal finance habits? To avoid the feeling of overwhelm, we need to take James Clear’s advice from his book Atomic Habits and think small. His advice is to break our desired habits into 2-minute actionable steps so that by focusing on the system in place, one small step at a time, we end up achieving the overall goal.

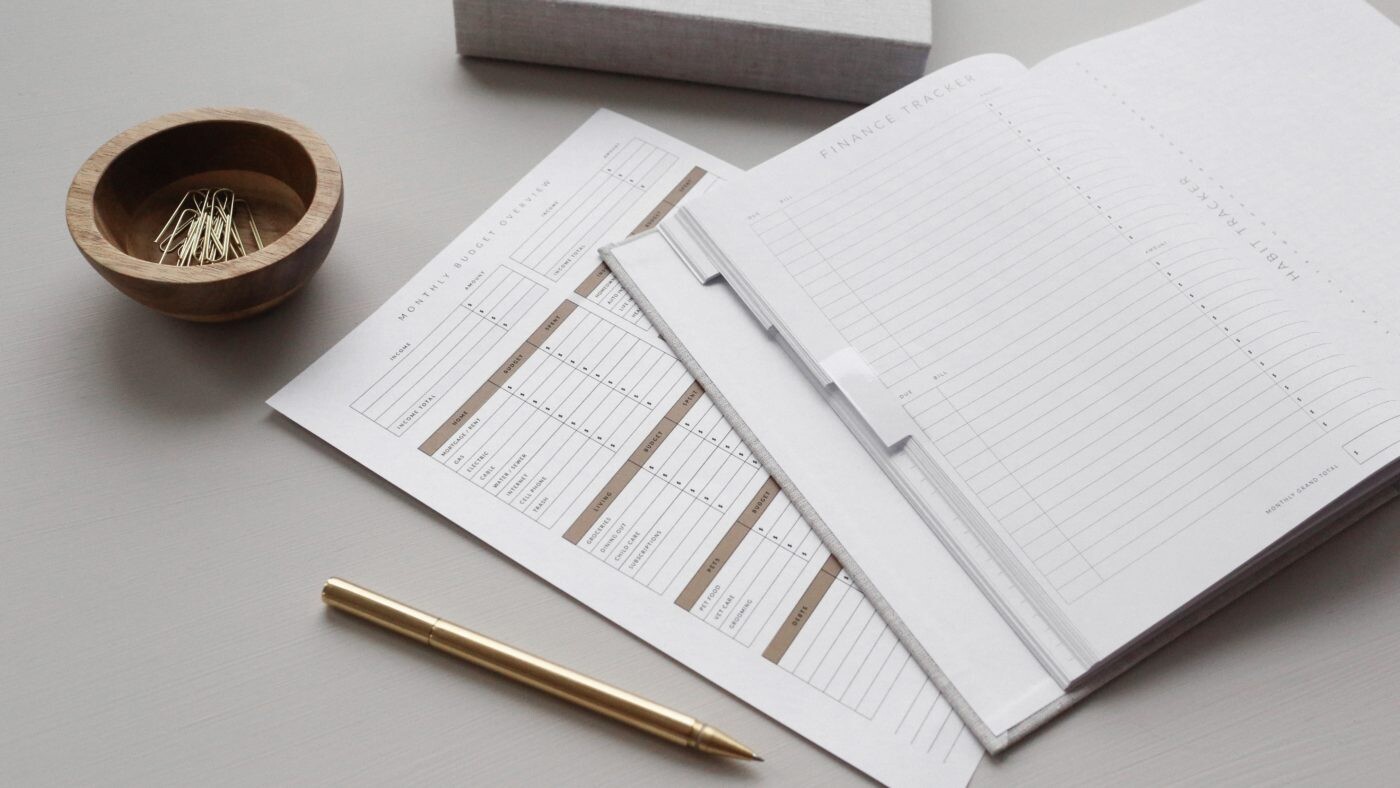

If you are the bill payer in your household, would someone else know what bills need to be paid if you aren’t available to take care of it? Even with online banking and bill pay in place, monitoring bank/credit card accounts to assure no fraudulent charges are occurring is crucial. This Expense Checklist can help you spend 2 minutes a day to get a system in place and create better personal finance habits when it comes to your expenses on your journey to getting financially organized.

Marie Burns is a Certified Financial Planner, Speaker and Author of the bestselling Financial Checklist books.